The risk reward ratio plays an important role in trading and is sometimes also called the ratio between chance and risk. The risk reward does not say anything about the probability of the success of the trade, but it defines the value of the trade and so it reflects the expected profit to the risk which was taken. Quite simply, the risk reward ratio is the ratio between profit and risk. It should generally be at least 1.5 or 2.

In our free Basic Package you will find an indicator which you can use as a tool to calculate the risk reward ratio. In this case the risk reward ratio will be shown directly on the chart.

Settings for the Risk Reward Ratio

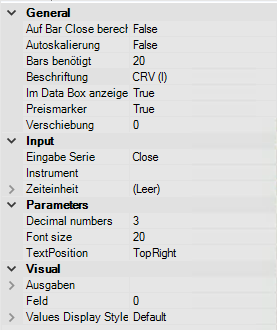

In the category parameters you can choose different charting settings. Decimal Numbers rounds the result of the Risk Reward Ratio calculation to 3 digits. Use the Font Size field to select the size of the text drawing on the chart. In the TextPosition field you can choose the position on the chart.

Display the Risk Reward Ratio

In the chart below we see the chart of Apple (symbol: AAPL) with three orders: Entry, Stop and Target. The risk reward ratio is shown in the upper right corner of the chart and consists of two values. On the right side we see the risk reward ratio calculated by the difference between prices. If there are several stops or targets used, a mean price value is used for calculation. On the left side we see the risk reward ratio calculated by the position size. The “plus” sign shows you that our entry position size was larger than the target position size, so in this case we have some shares left in our portfolio when the target price level was reached.

Download

The Risk Reward Ratio tool is part of our free basic package.